Lexington Law Review

- More than 17 years of experience

- Lawyers and paralegals are at your disposal

- Numerous positive reviews

- Top-notch credit repair apps

- User-friendly platform

In business since 2004

Payment plans from $79.99 per month up to $119.99

A ‘quickstart my case’ $14.95 fee

BBB rating – C

Staffed by experienced & knowledgeable legal professionals

If you’re wondering if Lexington Law can improve your credit situation, stay tuned for an in-depth Lexington Law review. If you’ve ever felt the economic pinch, you can rest assured you’re not the only one. Since the financial system is built on debt, many of us face the inevitability of taking out credit to support our lifestyles. This can empower us to lead our lives to the fullest but can leave us living a nightmare when credit accumulates uncontrollably.

Credit repair is a great way to achieve debt consolidation and overcome the living nightmare of bad debt and the amounting difficulties associated with it.

Credit repair involves absolving bad credit by any means. However, it is usually specifically associated with disputing errors on credit reports to eradicate bad debt.

Resolving disputes requires vast and complex knowledge, which is why it’s probably best left to the professionals.

What is Lexington Law?

Lexington Law is an established credit repair firm that’s been around since 2004. As one of the biggest names in the space, the Lexington Law firm has worked closely with thousands of consumers who aspire to clean up their credit history.

It’s not uncommon for online users to doubt the legitimacy of Lexington Law. After all, how could a company possibly wipe out bad debt entirely? Well, with a team of highly qualified legal professionals, Lexington Law is fully equipped to leverage evolving credit laws to deliver value to its customer.

Working under the latest federal standards, the company has an incredible success rate. According to official Lexington Law statistics, clients get on average 10.2 negative items removed from their records. Lexington Law has also removed a whopping 56 million negative items since its inception.

These tangible savings are testament to what the firm is all about: Using expert legal knowledge to remove financial liabilities.

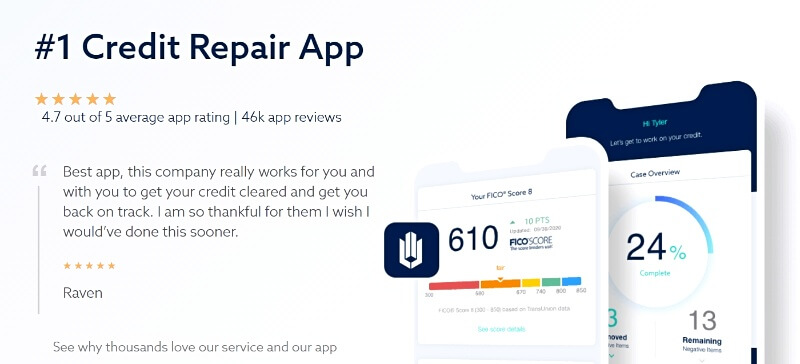

Lexington Law has poured vast resources into digital tools, with a huge online presence on its website and app.

Pros and Cons of Lexington Law

There are many Lexington Law reviews online. If you’re contemplating signing up with the firm, it’s worth weighing up some of the cons and benefits of collaborating with them.

Pros

As one of the leading companies on the market, there are many ways you can benefit from working with Lexington Law:

- Reasonable Pricing – Services start from just $89.95. This is very reasonable, especially when you consider the money you’re almost certain to save after signing up.

- Personalized Service – The company commits to customized service based on the case in hand. Every approach is tailored to the individual, meaning you’ll receive the bespoke help you need. When a paralegal is assigned to your account, they’ll stay with you for the duration.

- Legitimate Law Firm – Lexington Law is a real firm, staffed by experienced, knowledgeable legal professionals. With a focus on quality, services differentiate from competing firms by doing everything necessary to empower their clientele.

- Favorable Reviews – They have received many positive online reviews from previous customers. This is evidence of the trustworthy, reliable nature of the services offered.

- Experience – Lexington Law has been in the credit repair business since 2004. In an industry that’s littered with scams, they lean on longevity as proof of reliability and the likelihood of achieving an optimal outcome.

Cons

Despite being renowned for its exceptional service, there some inevitable cons to watch out for:

- Average BBB Rating – The Better Business Bureau (BBB) assigns ratings to companies within the credit industry. Unfortunately, the company has received a meager C rating, while accruing over 500 complaints on its Lexington Law BBB profile. However, the company is very responsive to individual cases, doing its best to address pressing customer service issues and resolve problems accordingly.

- Extra Cost – Lexington Law charges a sneaky extra $14.95 to customers as part of a ‘quickstart my case’ scheme. However, this can be quite convenient, since it allows Lexington to effortlessly load TransUnion reports in its systems. What’s cheeky is this extra fee isn’t disclosed and goes to a third party. There is also uncertainty surrounding whether you’ll have to wait longer to reap the benefits of the service if you don’t pay this extra fee.

- Legal Action – Lexington Law has outstanding legal matters concerning ‘deceptive business practices.’ The Consumer Financial Protection Bureau (CFPB) prohibits companies from collecting a fee before work has been done. This notion has been counterclaimed by Lexington representatives, who have filed a motion to dismiss the lawsuit.

How Does Lexington Law Work?

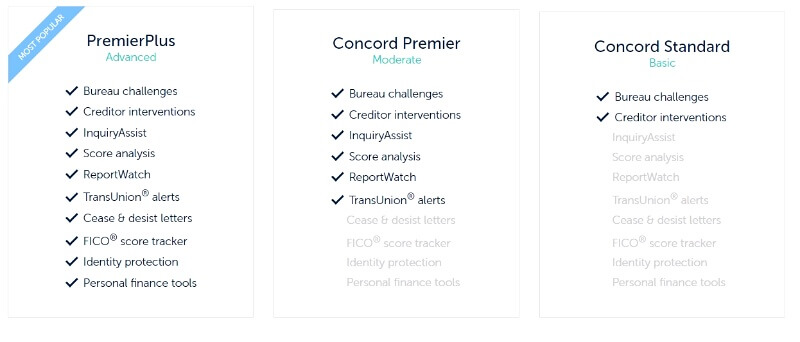

Lexington Law offers many levels of service across different price plans.

The plans include PremierPlus, Concord Premier, and Concord Standard, with each covering different aspects of credit repair.

Concord Standard:

- Bureau Challenges

- Creditor Interventions

Concord Premier:

- Bureau Challenges

- Creditor Interventions

- InquiryAssist

- Score Analysis

- ReportWatch

- TransUnion Alerts

Premier Plus:

- Bureau Challenges

- Creditor Interventions

- InquiryAssist

- Score Analysis

- ReportWatch

- TransUnion Alerts

- Cease & Desist Letters

- FICO Score Tracker

- Identity Protection

- Personal Finance Tools

When you visit the website or download the Lexington Law app, you’ll receive a free consultation from one of the company’s experts. A representative will be on hand to walk you through the services on offer.

Following an initial consultation, representatives of the company work with customers to determine a route to cleaning up credit reports and improving scores.

The company’s website contains a wide range of educational resources, to help people learn more about their financial rights and what they’re entitled to. The Lexington Law website contains several useful articles on bankruptcy, building credit, and more.

But what exactly should you expect from the process? Every individual case differs, depending mostly on the unique circumstances in question. However, there is a general pattern of events that’s roughly the same for every customer.

Lexington Law starts by offering a complete review of your situation, as an analysis of your credit report summary and score.

You’ll then go through onboarding, supplying credit reports from Experian, TransUnion, and Equifax. If you’re struggling to get your hands on your reports, Lexington Law will assist you.

During onboarding, you’ll have an opportunity to evaluate your circumstances with a trained paralegal. You’ll gain insight into what can be disputed during the credit repair process, uncovering which items are questionable and worth pursuing.

From this point onward, everything is left in the hands of a top professional. An advanced team of paralegals and attorneys will work out the best strategies to return value to the customer, negotiating items on your report.

Lexington Law sends correspondence to creditors and bureaus, investigating incomplete information, mistakes, and simple fixes.

Lexington Law Plans

Lexington Law has three main plans with different functionalities. To decide which plan is most suited to your individual needs, you should evaluate the services referenced above to make a good decision.

You can choose between the Concord Standard Plan, the Concord Premier Plan, or the Premier Plus Plan:

Concord Standard Plan – $89.95 per month

Lexington’s basic package is ideal for ‘standard credit repair’ that covers creditor interventions and bureau challenges for a reasonable Lexington Law monthly fee.

Despite seeming limited, surprisingly the basic plan will do the job for most people, sufficient to successfully dispute negative items. However, if you’re seeking something better, it’s worth considering the following options.

Concord Premier – $109.95 per month

If you can afford to pay a bit extra, you’ll appreciate the features of the Concord Premier plan. Get coaching on how to more effectively manage your credit, alongside a monthly score analysis report to monitor how your credit has improved.

You’ll also be entitled to receive TransUnion alerts whenever negative items appear on your report. The extras here are nice to have, but not essential.

Premier Plus – $129.95 per month

Enjoy all of the features of the previous packages, with a few additional extras that come with the premium plan. You’ll be treated to FICO score tracking, various personal finance tools, cease and desist letter services, and identity protection.

Similar to the Concord Premier plan, the extras offered here are great as a bonus, but not essential to resolve most disputes.

Best Alternatives to Lexington Law

When it comes to selecting the right company, it makes sense to shop around and consider the diverse options at your disposal.

Perhaps you’ll find an alternative solution that’s better suited to your needs. Here are some of the best credit repair companies on the market:

Sky Blue

If a credit repair company has been in business for a long time, this is usually a good indication of reliability. If this rings true, Sky Blue is without question one of the most trustworthy of all. Since its inception in 1989, Sky Blue has been helping thousands of customers repair their credit history.

Pricing is easy at Sky Blue. You pay a flat fee of $19 to sign up, followed by a monthly fee of $79 once you’re enrolled with the service. You’ll also get a 90-day money-back guarantee!

Credit Saint

Here there are three variations of payment plans, starting at $79.99 per month up to $119.99. Each plan involves an initial setup fee, though you can benefit from a free consultation before signing up.

It’s great to know what you’re signing up for. You’ll be working with a credit repair company with an A+ rating from the BBB.

Creditrepair.com

At creditrepair.com, you can effortlessly discover what’s hurting your credit score and work with professionals to determine how to fix issues.

There are three main payment plans to consider:

- Direct: $69.95 – bureau challenges, inquiry assists, goodwill intervention, quarterly credit scores.

- Standard: $99.95 – bureau challenges, inquiry assists, goodwill intervention, quarterly credit scores, FICO Score Inquiry Assist service.

- Advanced: $119.95 – bureau challenges, inquiry assists, goodwill intervention, quarterly credit scores, FICO Score Inquiry Assist service, cease and desist interventions, monthly credit score updates.

DIY Credit Repair

If the Lexington Law client reviews didn’t impress you, all is not lost, in fact, you might not even need to work with a professional! Believe it or not, resolving credit issues on your own is not impossible.

It can seem overwhelming, but with advanced research and financial know-how, you can dispute your errors using online templates to help.

DIY credit repair won’t cost a thing and will give you the freedom to explore the process at your leisure. Taking advantage of free guides will give you the flexibility to face your demons independently, a gratifying experience.

Comparison Table

| Company | Lexington Law | Sky Blue | Credit Saint | Creditrepair.com |

| Experience | Operating since 2004 | Operating since 1989 | Operating since 2004 | Operating since 2012 |

| Price | $89.95 – $129.95 per month | $79 per month + $19 setup fee | $79.99 – $119.99 per month | $69.95 – $119.95 per month |

| Money-back Guarantee | N/A | 90 days | 90 days | N/A |

| Services | Bureau Challenges

Creditor Interventions InquiryAssist Score Analysis ReportWatch TransUnion Alerts Cease & Desist Letters FICO Score Tracker Identity Protection Personal Finance Tools |

Challenges

Score Analysis + Monitoring Credit rebuilding guidance SOL Research |

Unlimited Challenges

Score Analysis Score Tracker Creditor Interventions Score Tracker Experian Monitoring Inquiry Targeting |

Challenges

Score Analysis Creditor Interventions Experian Monitoring Inquiry Targeting Identity Protection |

| Mobile Apps | iOS + Android | N/A | N/A | iOS + Android |