Ovation Credit Repair Services Review

- Free service cancellation at the desired time

- Free consultation

- Associated with Lending Tree

BBB Rating: A+

Setup fee: $89

Monthly fee: $79 – $109

Your credit score can affect many different aspects of your financial life. If you’re struggling with a low score, Ovation Credit Repair can help. When choosing a repair service, it’s essential to find a company that you can trust. That’s why it’s so important to look at Ovation Credit reviews and consider all your options before deciding which service you’ll use.

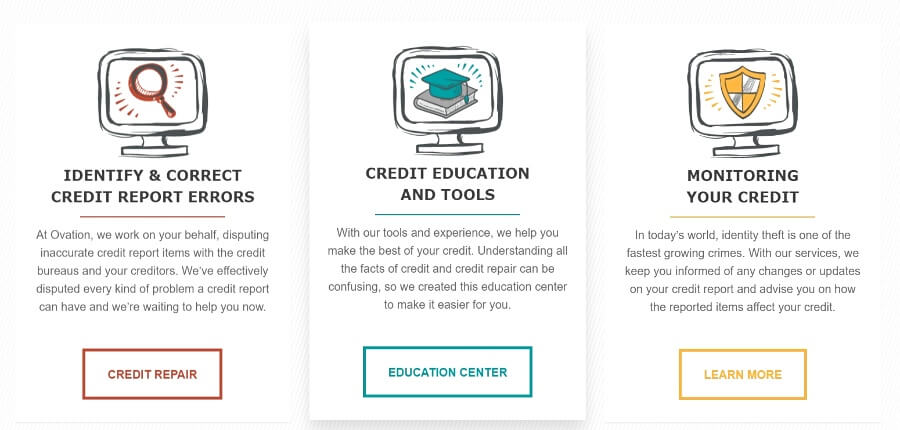

Ovation has a long history of providing repair services and financial education for its customers. The company improves its clients’ credit scores by disputing inaccurate listings on their reports. They provide personalized services tailored to your needs and can also help you maintain a good rating once your score has gone up. Here’s what you need to know about this repair company before signing up.

What Is Ovation Credit Repair Services?

Ovation is based in Jacksonville, Florida. However, it offers its repair services to anyone throughout the United States. It also provides credit monitoring and education services. The enterprise was founded by attorneys and is now a LendingTree company. LendingTree is a publicly traded lender with a positive reputation.

This company prides itself on offering free consultations and payment plans. You can sign up and pay online, and it offers personalized customer service to solve many different types of loan issues. Its monitoring and education services are designed to help customers better understand how the system works and prevent potential issues before they happen.

Pros and Cons of Ovation Credit Repair Services

There are many advantages to using Ovation to improve your credit score. One of the biggest advantages is that they provide a free consultation. This means you can talk directly with a credit repair expert and get an idea of whether the service suits you before committing to it. Their prices are about average for the industry, ranging from $79 to $109 per month.

Another advantage is that they provide same-day services for those who need them. If you’re in a tough financial spot and you need to fix your credit right away, you can use Ovation’s Fast Track service.

Ovation has a variety of packages, so you can customize them to get exactly what you need. Its basic plan starts with credit dispute services, but you can pay more for additional guidance and monitoring.

Finally, Ovation is owned by LendingTree, which is a very reputable company. It has an A+ rating from the Better Business Bureau, indicating that it has been able to consistently provide trustworthy service to its customers.

However, there are also some disadvantages to using Ovation’s services. The biggest is its lack of online support. Even though you can sign up for online repair services, the entire process is conducted over the phone. You can reach the team by email, but there is no chat function or 24/7 support. Ovation’s phone support is only available within business hours: from 8 AM to 9 PM Eastern time on weekdays and 10 AM to 4 PM on Saturdays. This may make it difficult for clientele with busy schedules to get the credit repair services they need.

Another disadvantage is that you need to upgrade to the Essentials Plus plan to get a credit monitoring service. Many other services offer ongoing monitoring for free, which puts Ovation at a disadvantage.

How Does Ovation Credit Repair Work?

There are a few ways that Ovation can fix your credit score. The main way they fix scores is by disputing items on your report. According to statistics on the Ovation website, at least 25 percent of credit reports contain serious errors that could affect your score or even result in denial of a loan in the future. By analyzing your report and disputing items that are incorrect, you can potentially boost your score. Ovation’s expert consultants will help you navigate the process, which can be challenging to figure out on your own.

All of Ovation Credit Repair’s offerings also include resources to assist you with your financial planning. A personal analyst can provide assistance with setting up a reasonable budget and debt repayment plan. Making regular payments is key to getting rid of debt and improving your credit score, so these simple steps can be very helpful.

If you pay for Ovation’s Essentials Plus plan, you can get an unlimited amount of dispute, goodwill, and recommendation letters. Goodwill letters are different from disputes in that they ask your creditors to rescind certain reports or stop reporting certain items. While your creditors are under no obligation to do this, many of them will if you can make a strong case for why these items shouldn’t be on your credit report.

The Essentials Plus plan also comes with TransUnion credit monitoring. This monitoring consistently assesses new line items on your report to look for inaccuracies. This helps you catch potential problems with your credit score as soon as they appear. It’s not enough to just fix your score now — you’ll need to maintain it in order to do things like take out a mortgage, buy a car, or rent an apartment.

Ovation Credit Prices

Ovation Credit Repair’s prices are generally considered to be average for the services they provide. While they aren’t significantly more expensive than the competition, they aren’t the cheapest option on the market either.

Ovation has two plans to select from. These are the Essentials and the Essentials Plus plan. The first one includes access to your personal case adviser, credit dispute assistance, and financial management tools. The Essentials Plus plan includes all of the above, but it also includes an official recommendation letter, unlimited challenges and goodwill letters, and TransUnion monitoring services.

Both plans have an initial fee of $89. After that, the Essentials plan costs $79 per month, while the Essentials Plus plan costs $109 per month.

The enterprise also offers discounts for some customers. It offers a $50 credit for any customer who switches to Ovation from another agency. It also offers a $30 credit for referrals. There is a 20 percent discount for couples and a 10 percent discount for military members as well as senior citizens.

Best Alternatives to Ovation Credit Repair

Ovation is an excellent service with many benefits. However, there are also several viable alternatives. Here are three notable enterprises that are among the best credit repair companies. These would all be suitable replacements for Ovation.

Credit Saint

This is another popular service in the United States. Like Ovation, it offers both repair services and education. However, it also offers additional services, like interventions with creditors and inquiry targeting. It offers free consultations over the phone, but there is also an online dashboard for customers where you can track your progress. Therefore, Credit Saint could be a better choice for those who would prefer to manage their credit online instead of having the entire process happen over the phone.

Lexington Law

Lexington Law is very similar to Ovation. It can both challenge credit bureaus directly and offer monitoring tools. What makes Lexington Law slightly different from Ovation is that it has three different packages, and you’ll need to purchase the highest-level package to access features like personal finance tools, identity protection, and a FICO score tracker.

Sky Blue

Sky Blue has been in business for over 30 years. It differs from Ovation Credit services in that it offers one comprehensive plan that includes more than 15 disputes as well as goodwill letters, cease and desist letters, and guidance to help you rebuild your credit score. You can also manage your account online or from their app, instead of working over the phone. However, you may be limited in terms of custom features because the plan is one-size-fits-all.

| Ovation Credit Repair | Credit Saint | Lexington Law | Sky Blue | |

| Number of plans available | 2 – Essential & Essential Plus | 3 – Credit Polish, Credit Remodel, Clean Slate | 3 – Concord Standard, Concord Premier, PremierPlus | 1 |

| Price | $79 to $109 per month, $89 initial work fee | $79, $99, or $119 per month. $99 or $195 initial work fee | $89.95 to $129.95 | $79 setup fee, $79 monthly fee |

| Contact Method | Phone | Phone, online dashboard | Phone, online signup | Online signup, app |

| Key Features | Custom dispute letters, official recommendation letter, financial management tools | Credit bureau challenges, creditor interventions, score monitoring | Score analysis, dispute letters, cease and desist letters, identity protection | Analysis, custom disputes, debt verification, and challenges |

| BBB Rating | A+, accredited | A, accredited | C, not accredited | C, not accredited |