The Credit People Review

- The best recommendation for guaranteed services

- Get started at $19

- Three account managers

- Monthly subscription at $79

BBB Rating: C+

Setup fee: $19

Monthly fee: $79

The Credit People is an online credit repair firm that helps its clients resolve negative items in their reports. They ensure that everything in the report card from the top bureaus belongs there and is fairly reported. Over 100,000 clients have benefited from their services.

Customers may cancel at any time and not get charged for any services rendered in the course of the month. The firm issues the last month’s payment as a refund. Getting started is risk-free thanks to their free, no-strings-attached consultation.

Our The Credit People review reaffirms the company’s commitment to offering friendly and trusted services. They don’t make any false claims and have not had any trouble with regulatory agencies. Most of their reviews are positive. At $19, the initial work fee is more than affordable.

What is The Credit People?

The Credit People began operating in 2001, with sights set on becoming one the best credit repair services. The company likes to keep things simple. That’s expressed in their one pricing package. Many repair firms have 2 to 3 packages with different features. Sometimes customers choose the most expensive packages with options they never need.

The Credit People acknowledges that not everyone needs credit repair. And sometimes, their efforts are not successful. So, during the free consultation, the analyst determines how compatible their services are with the customer’s reports. They don’t charge for the first seven days of service. Billing is at the end of the month in accordance with FCRA requirements.

There is little on the website about the owners or profiles of the team members. But they mention their hand-picked teams, including:

- Credit Repair Team – Facilitates the dispute process and works on a one-to-one basis with the customer.

- Score Analysis – Provides specialized assessment of credit reports. The team further advises on credit rebuilding steps a customer can take.

- Support – Handles all customer-related queries.

- Other teams: Sales, Executive, Tech, and Marketing

Pros and Cons of The Credit People

Aside from their refund policy, affordable The Credit People plans, and personalized services, more benefits include:

- Modern case monitoring portal. We like the feel of The Credit People portal. It’s well laid out into sections, including Profile (progress updates), My Credit (tracking credit accounts), Upload (documents from CRBs), and Help Center. You may use a mobile device to access it, too.

- A simple website with all the information. The company doesn’t leave any questions unanswered. They explain each aspect of their service, what they can and cannot do.

- Help zone resources. Learn about credit management and good financial habits from their articles, videos, and infographics.

- Team help. With up to three account managers working with a single customer, the company ensures continuous service. There are no delays, for instance, when one account manager goes on holiday.

Some limitations of the service entail:

- Not the best guarantee. The company promotes their “UNBEATABLE” satisfaction guarantee. There are similar providers with 90-day money-back plans that are way superior.

- Technological gap. Sadly, there are no apps — the company sends updates on email and online accounts. Some companies offer text & app alerts, which are more convenient.

What people like in reviews

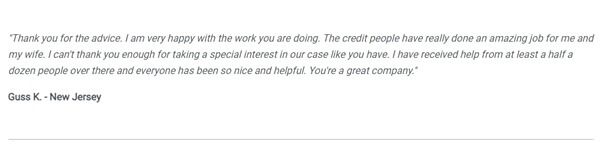

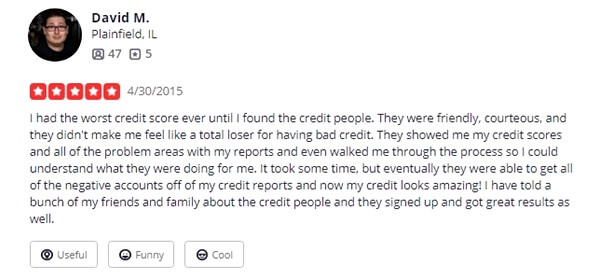

The main website features positive reviews and stories. But there are few places to find external thecreditpeople.com reviews. On Yelp, there were only five reviews dating from 2013 to 2015, and the page was unclaimed.

Here are a few samples of some of the best reviews from their testimonials page & Yelp:

What people don’t like in reviews

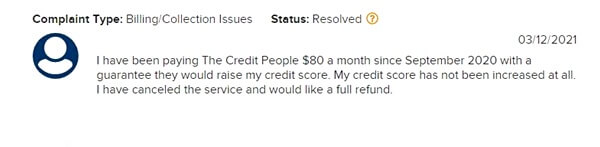

Credit repair firms often come under fire for not delivering results as quickly as some customers expect. That’s why the company states that results may be in 60 days. For complaints, we checked The Credit People BBB page.

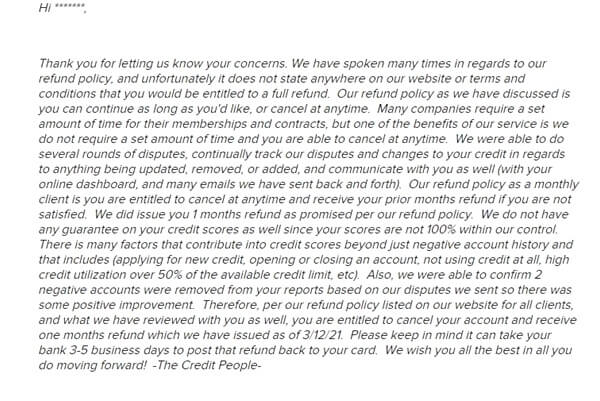

There were only 9 complaints in the last 3 years for their Cottonwood Heights, UT location. We highlighted their latest complaint, where the customer asked for a full refund:

We found their response honest and transparent. And the company was willing to issue the refund. However, they can’t give a full refund but only the last month’s payment as per their policy.

How Does The Credit People Work?

What can a new customer anticipate during sign-up? Well, The Credit People legal credit repair process entails:

1. Speaking to the team first

For customers with doubts about how credit repair works, free evaluation can help clear any doubts. Requesting the phone evaluation is easy. Go to their website. Drop your contact information on their “Free consultation” page or call the provided number. Customer service hours are from 5-9 p.m. CST, Mondays – Fridays.

2. Creating a new customer account

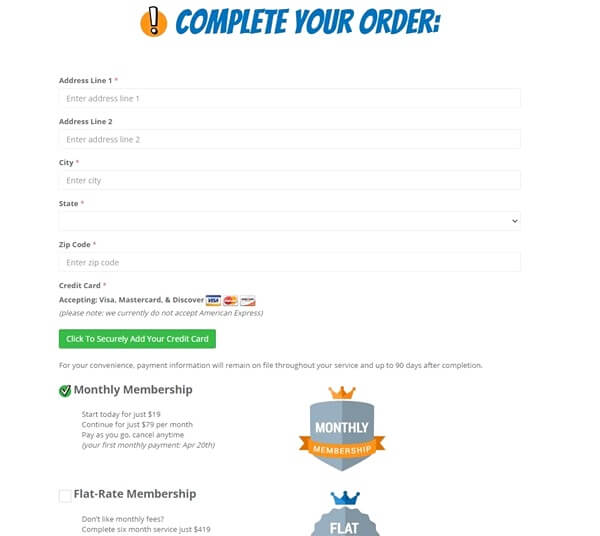

Want to order the service without the initial consultation? The Credit People sign up process is as follows:

- Navigate to their website.

- Select “Get Started.”

- Provide an email address, name, and phone number.

- Click on the confirmation link to access the online portal.

- Complete the order.

3. Obtaining the full credit evaluation

A member of the credit repair team will call and send the welcome email. The firm also pulls the reports from the CRBs to analyze for negative entries.

Customers don’t need to explain their negative items. The company has encountered literally every credit scenario. But clients may point out items that the repair team should not dispute.

There may be more requests for identification, and they show up in the portal as “client requests.”

4. The official start of the dispute process

The company will challenge both creditors and CRBs. New clients should also expect copies of their updated reports from the CRBs in 30-45 days.

Reporting agencies often send communications through the mail. Clients can easily upload them through the portal for the team.

5. Seeing results

Investigations into disputes may take place over 30 to 45 days, so it’s essential to be patient. The company sends updates on cases on the secure portal.

6. Receiving a future plan

The Credit People never wants clients to need them again. So, they create future custom plans to help customers maintain the improved credit record.

Credit Restoration Features

As one of the top firms, The Credit People offers extra services that make their package dynamic. Not only will they dispute negative records, but the team also provides:

- Score-Driven Results® Promise: It’s the company’s vow to try other approaches when improving their client’s credit score. They may recommend the best credit rebuilding loans. Or work with the customer to develop better financial habits.

- Creditor Communications: The firm may intercede on behalf of their clients on legitimate debts. This entails writing GoodWill or Pay for Delete Letters to creditors. For collection agencies that are pushing too hard, the repair team may write Cease and Desist letters.

- Debt Validation: Doubting the amount requested by a collection agency on a debt? The firm may help prepare a debt validation letter to establish the legitimacy of owed accounts.

- Inquiry Validation: The Credit People will also prepare a credit inquiry removal letter. It alerts the CRBs that a hard inquiry may have been unauthorized and should be removed.

The Credit People Prices: Monthly Plan vs. 6 Month Plan

There is only one package — so no time is wasted selecting or comparing plans. The only thing that differs is how to pay: monthly vs 6-months upfront.

The Credit People cost for 6 months of service (paid upfront) is $419, which leads to savings of $74. But is this not riskier? The company provides a six-month satisfaction guarantee on their flat-rate membership. Now $400 may seem like much. But with some repair firms, customers pay up to $300 in the first month alone (monthly subscription fee + setup fee).

And why do they offer a six-month membership and not 3 months? The credit repair process is lengthy. While they offer unlimited disputes, they can’t challenge every negative item at once. The company may need to file for redisputes after the CRBs turn down certain challenges.

Best Alternatives to The Credit People

How does the service compare with some of the best credit repair companies? Let’s find out:

| The Credit People | Lexington Law | Credit Saint | Sky Blue | |

| Guarantee | 1-month | No | 90-days | 90-days |

| Experience | 20 yrs+ | 17 yrs+ | 17 yrs+ | 32 yrs+ |

| Costs | $79 | $90 – $130 | $80- $120 | $79 |

| Unlimited disputes | Yes | No | Yes | No |

| Work fee | $19 | $89 – $129 | $99 – $195 | $79 |

| Mobile Apps | No | Yes | No | No |

| Portal | Yes | Yes | Yes | Yes |

Here is a further breakdown of each service against The Credit People:

Credit Saint – Known for Reliability

Both companies have similar perks! They have unlimited disputes and money-back guarantee policies. So, why choose The Credit People? “Favorable fees.”

The most expensive Credit Saint package goes for $120 with a setup fee of $195. That’s more expensive because The Credit People monthly fee is $79 with a $19 initial fee.

Lexington Law – Leading Repair Company

Lexington Law has one of the best credit apps. It has a more established history with up to 500,000 active users and many reviews on third-party sites. Its top package also includes ID protection and personal finance tools.

The Credit People is a less popular service that garners about 3,000 new users per month. While it’s cheaper, it doesn’t have personal finance features. There are not as many The Credit People reviews.

Sky Blue – Best Money-back Offer

Sky Blue charges the same monthly fee at $79, with similar credit restoration features. But disputes are restricted to 15 per cycle compared to the unlimited offer from The Credit People. At $19, the firm’s initial work fee is $60 cheaper. When working on a tight budget, the choice is clear.